|

1. Preconditions

for charge u/s. 45

Income under the head “Capital Gains” can be charged only if the

following three conditions are satisfied

a. There must be

a “capital asset” [for definition of “capital asset” refer S.

2(14)];

b. There must be

a “transfer” of such capital asset [for meaning of

“transfer”, refer Ss. 2(47), 47 & 46(1)]; and

c. There

must arise either profits or gains or loss out of such transfer.

2. Year of

Chargeability

Capital Gains are generally charged to tax in the year in which

“transfer” takes place (For exception to this general rule, refer

column (4) of Table 3)

3. Mode of

Computation

3.1 Income under the head Capital gains is to be

computed as follows

|

a)

In respect of capital assets otherthan

depreciable assets

|

as per S. 48

|

|

b)

In respect of depreciable assets other

than mentioned in (c)

|

as per S.

50

|

|

c)

in respect of depreciable assets ofan

undertaking engaged ingeneration or

generation anddistribution of power

|

as per S. 50A

|

|

d)

In respect of slump sale

|

as per S. 50B

|

3.2 Capital gains u/s. 48

are computed as follows:

|

a)

Full value of consideration received or

accruing as a result of the transfer of

capital asset [also refer column 5 of Table 3]

|

a

|

|

b)

LessExpenditure incurred wholly &

exclusively in connection with transfer

[Expenditure by way of Securities

Transaction Tax is not allowable.]

|

b

|

|

c)

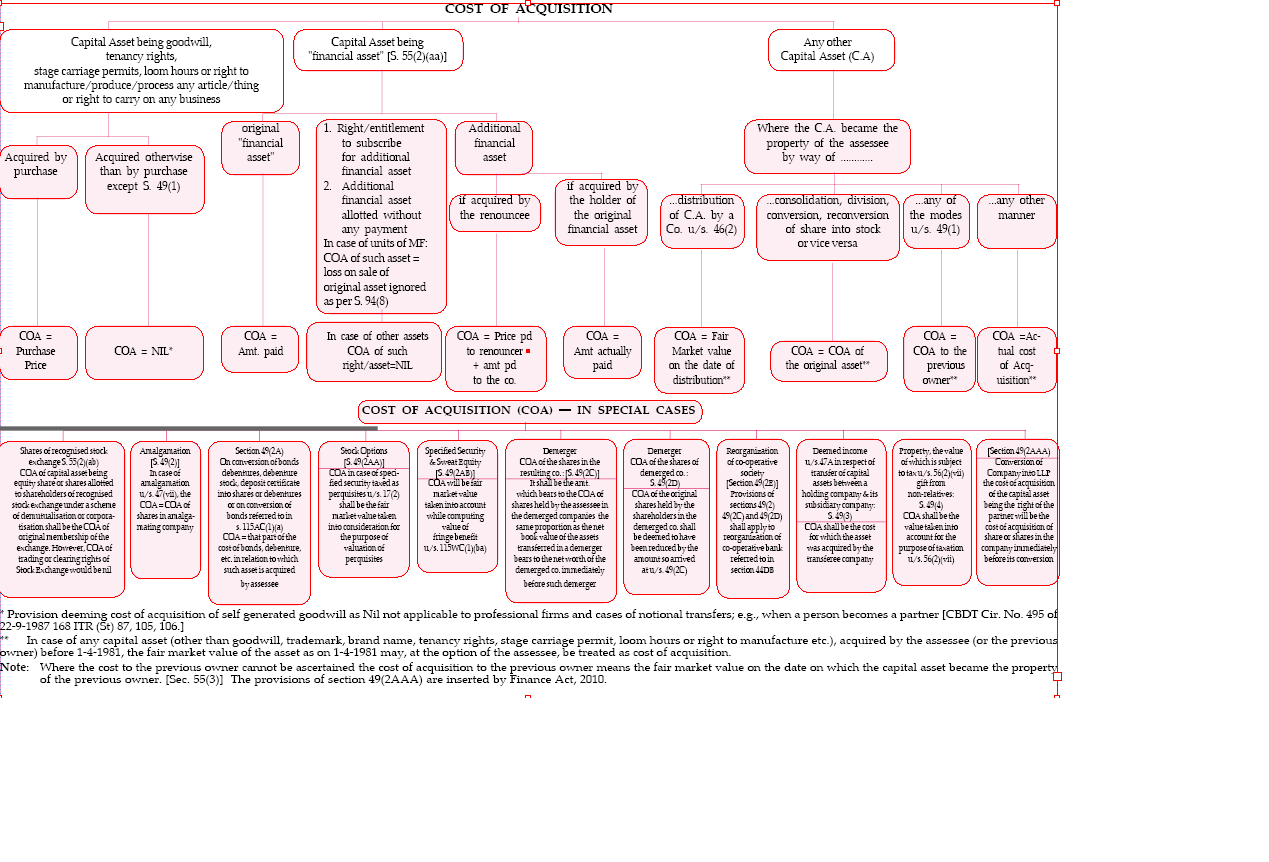

LessCost of acquisition and cost of

improvement (refer tree diagram below)

|

c

|

|

d)

Cost of acquisition in c) above to be reduced by advance money received,

if any (S. 51)

|

d

|

|

Income/Loss chargeable u/s. 45 r.w.s. 48

|

[a-b-(c-d)]

|

Exceptions to S. 48:

-

In case of a

non-resident, Capital Gains on transfer of shares in or debentures of an Indian

company

are to be computed firstly by converting cost of acquisition, full value of

consideration and expenses incurred in connection with transfer into originally utilised foreign currency and reconverting the capital gains so computed into Indian

rupees.

Rule 115A

prescribes the rates of conversion and reconversion for the purpose of calculation of

capital gains in the above case. The rates of conversion and reconversion are as

follows:

|

Cost of acquisition

|

the average of telegraphic transfer

(TT) buying rate and TT selling rate (as on the date of acquisition) of

the foreign currency utilised in the purchase of asset

|

|

Expenditure ncurred wholly and exclusively in

connection with transfer consideration

|

the average of TT buying rateand TT selling

rate as on the date of transfer

|

|

Full value of consideration

|

the average of TT buying rate and TT selling

rate as on the date of transfer

|

|

For reconverting the capital gains

|

TT buying rate as on the date of transfer

|

-

The benefit

of indexation of cost will not be available for computation of Capital Gains on

transfer of Bonds/Deb.

-

While

calculating long-term capital gains (other than those covered under (a) and (b)

above) cost of acquisition and cost of improvement are required to be indexed at

prescribed indices (refer Table 2)

3.3 Capital gains u/s.

50 are computed as follows:

|

a) Opening W.D.V. of the Block

of Assets

|

‘a’

|

|

b)

Less Full value of consideration received

or accruing as a result of transfer or transfers

of asset falling within the concerned block of assets

during the relevant previous year

|

‘b’

|

|

c)

Less Expenditure incurred

wholly and

exclusively in connection with such transfer or

transfers. This deduction would not be available

in a case where the entire block ceases to exist as

such, for the reason that all the assets in that block

are transferred during the

year. ‘c’

|

’c’

|

|

d) Add Actual cost of any

asset falling within the

concerned block of assets acquired during the

relevant previous year.

|

‘d’

|

|

Resultant

figure

|

a+c+d-b

|

If the resultant figure is negative, the same is chargeable as deemed short-term

capital gains u/s. 50.

If the resultant figure is positive and the entire block ceases to exist as such

(for the reason that all the assets in that block are transferred during the year)

the resultant figure indicates deemed short-term capital loss (refer CBDT Circular

No. 469 dated 23-9-1986 — reported in 162 ITR (Stat) 21, 30).

If the resultant figure is positive and the block continues to exist (For the

reason that at least one asset in the block continues to be owned by the assessee)

then there will be no gains or losses and the assessee will be entitled to claim

depreciation on the resultant figure.

3.4 Capital Gains

u/s. 50B

Profit arising on slump sale of one or more undertakings would be chargeable to

tax as Long-Term Capital Gain in the year of transfer if such undertakings have been

owned and held by the assessee for at least 36 months before the date of transfer or

as Short-Term Capital Gain if held for a shorter period.

The networth (as defined) of the undertakings would be regarded as the cost of

acquisition and improvement. No indexation would be allowed in respect of such

cost.

3.5 Indexation

In case the capital asset is a long-term capital asset, the cost of acquisition is

to be increased by cost inflation index. The prescribed cost inflation index is given

in column (2) of Table 2 below. Column (4) gives the multiplying factor in case of

capital asset sold in financial year 2012-13.

For example, if cost of acquisition of an asset acquired in F.Y. 1994-95 is

`50,000, its indexed cost of acquisition in F.Y. 2012-13 would be `1,64,478 (i.e.,

50,000 x 3.289575)

4. Exempt Capital

Gains

Refer sections 10(33), 10(37), 10(38), sections 54 to 54GB and section 115F

5. Rate of Tax on

Capital Gains

Refer “Rates of Tax” on

click here

TABLE 1

|

S.No.

|

Capital Asset

|

Minimum Holding Period for "Long-Term"

|

|

1

|

Shares in a Company

|

12 months

|

|

2

|

Any other listed security

|

12 months

|

|

3

|

Units of Unit Trust of India

|

12 months

|

|

4

|

Units of a Mutual Fund specified u/s. 10(23D)

|

12 months

|

|

5

|

Any other Capital Asset

|

36 months

|

CAPITAL GAINS ON SPECIFIC TRANSFERS

('C.A.' refers to Capital

Asset)

|

Section

|

Particulars of

transfer

|

Capital Gains assessable in

the hands of

|

Year in which

chargeable

|

Amount deemed to be the full

value of consideration for the purpose of S. 48

|

|

45(1A)

|

Moneys/other assets received

from insurance company towards damage/destruction of C.A. due to certain specified

natural calamities

|

The person receiving the

money/assets

|

Year in which moneys/other asset is received from insurance

company.

|

Value of moneys/FMV of assets received from insurance

company.

|

|

45(2)

|

Conversion of C.A. into

stock-in-trade

|

The owner of such

asset

|

Year in which sale or transfer

of stock-in-trade takes place

|

FMV of the asset on date of

conversion

|

|

45(2A)

|

Transfer of Securities made by

depository.

(Refer note 1)

|

The beneficial owner of the

securities

|

Year in which such securities

are transferred

|

Amount of consideration

received

|

|

45(3)

|

Transfer of C.A. by a person to

firm/AOP/BOI as his capital contribution or otherwise

|

The partner or the member so

transferring

|

Year in which asset is so

transferred

|

The amount recorded in the

books of the firm / AOP / BOI

|

|

45(4)

|

Transfer of C.A. by way of

distribution thereof on dissolution of firm/AOP/BOI or otherwise

|

The firm/ AOP/BOI

|

Year of distribution

|

FMV on the date of

distribution

|

|

45(5)

|

Transfer of C.A. by compulsory

acquisition under any law OR transfer where consideration determined/ approved by

Central Govt./RBI

(a) Initial

compensation

(b) Enhanced compensation

|

The transferor

The transferor

|

Year in which initial compensation is first received

Year in which enhanced

compensation is first received

|

Amount of initial compensation as reduced by order of any Court/Tribunal/ other

authority

Enhanced amount (cost of

acquisition and improvement are deemed to be NIL) as reduced by order of any

Court/Tribunal or other authority

|

|

45(6)

|

Transfer of units referred to

in S. 80CCB(2) by way of repurchase

|

The transferor

|

Year in which repurchase takes

place

|

The repurchase price

|

|

46(2)

|

Distribution of assets of a Company

to its shareholders on its liquidation

|

The share holder

|

Year in which the share holder

receives any money or other assets

|

Moneys received from the Company +

Market value of other assets on the date of distribution less amount assessed as

deemed dividend u/s. 2(22)(c)

|

|

46A

|

Purchase by a company of its

own shares/specified securities (buy back of shares)

|

The share holder or the holder

of the specified securities

|

Year in which such shares or

other specified securities purchased by the company

|

Amount received from the

company

|

|

Proviso to s. 47(iii)

|

Shares, debentures, warrants

allotted to employees under Employees Stock Option Plan or Scheme framed in

accordance with guidelines issued by the Central Government

|

The employee

|

Year in which shares,

debentures, warrants are transferred under a gift or an irrevocable trust to the

employee

|

FMV on the date of its

transfer

|

|

50B

|

Slump sale of Capital assets or

business undertaking

|

The transferor

|

Year in which slump sale takes

place

|

The value received/receivable

as the sale

|

|

50C

|

Transfer of land or

building

|

The transferor

|

Year in which asset is

transferred

|

Higher of :

(i) sale consideration

(ii) value adopted / assessed / assessable by State Government for stamp duty

valuation

|

Note :

1. As per Circular No. 768,

dated 24th June, 1998, FIFO method shall be followed in case dematerialised

securities. Where the investor has more than one security account, FIFO method shall

be followed account wise.

2. As per Section 55A the AO may

refer to the Valuation Officer for ascertaining the fair market value of the asset

under following circumstances:

-

Where in view of the AO the

value of the asset claimed by the assessee in accordance with the estimate made by a

registered valuer, is less than is FMV or (w.e.f. 01.07.2012, section 55A,

clause (a) is amended as follows:

Where in view of the AO, the value

of the asset claimed by the assessee in accordance with the estimate made by a

registered valuer is at variance with its fair market value)

-

Where in view of the AO the

value of the asset claimed by the assessee is less than the FMV by so much percentage

or by so much amount as may be prescribed or

-

Having regard to the nature of

the asset and other relevant circumstances, it is necessary to do so.

The amendment in clause (a) above

is with effect from 1st July, 2012.

3. As per newly introduced section

50D (with effect from 1st April 2013), where the consideration received or accruing

as a result of the transfer of a capital asset by an assessee is not ascertainable or

cannot be determined, then, for the purpose of computing income chargeable to tax as

capital gains, the fair market value of the said asset on the date of transfer

shall be deemed to be the full value of the consideration received or accruing as a

result of such transfer.

4. The definition of agricultural

land has been amended and divided into three categories based on population and

shortest aerial distance. Notification by Central Government now not

required.

Cost of Acquations

Please click here

for Exempt Capital Gain

Notes

-

If the new asset

is transferred, within a period of 3 years from the date of purchase/construction,

the cost shall be reduced, in the year of transfer, by the gains exempted earlier.

-

If the gains are

not reinvested as specified, before the due date of filing the return u/s. 139(1),

then the amount not so reinvested is required to be deposited on or before that date

in an account in a specified bank/institution and utilised for the

purchase/construction of the relevant asset in accordance with the notified scheme

within specified time limit in order to continue availing of the benefit of exemption

[For the notified scheme, See 172 ITR (St.) 91].

-

Industrial

land or building must have been used for the purposes of the business of the

undertaking. New asset must be purchased/constructed for the purposes of

shifting/reestablishing/setting up industrial undertaking.

-

The assessee must

not own more than one residential house other than the new house on the date of the

transfer of the original asset.

-

The assessee must

neither purchase within two years after or construct within three years after the day

of transfer, any other residential house other than the one in which reinvestment is

made nor transfer the new asset within 3 years from the date of its

acquisition/construction, otherwise the amount of gains earlier exempted shall be

deemed to be LTCG in the year of such transfer.

-

The industrial

undertaking must have been situated in an urban area and the transfer must have been

effected as a result of shifting to a non-urban area.

-

The industrial

undertaking must have been situated in an urban area and the transfer must have been

effected as a result of shifting to a Special Economic Zone as defined in clause (za)

of the Special Economic Zones Act, 2005.

-

‘Foreign

Exchange Asset’ means any of the assets listed in Note 9 below which assessee

has acquired or purchased with, or subscribed to in convertible foreign exchange.

-

A 'Specified

Asset' u/s. 115F means :

-

Shares in an

Indian company;

-

Debentures issued by

Indian company which is not a pvt. company;

-

Deposits with an Indian company

which is not a private company;

-

Any security of the Central

Government as defined in S. 2(2) of the Public Debt Act;

-

Other notified

assets.

-

In case of compulsory

acquisition of asset under any law, time for reinvestment or deposit in specified

assets, of sale proceeds or capital gains as the case may be, as prescribed by Ss.

54, 54B, 54D, 54EC and 54F shall be reckoned from the date of receipt of compensation

as per provisions of

S. 54H.

-

Board Cir. No. 471 dtd.

15-10-1986 (162 ITR (St) 41) has clarified that cases of allotment of flats under the

self financing scheme of the Delhi Development Authority (DDA) should be treated as

cases of ‘construction’ for the purposes of Ss. 54 and 54F.

Similarly, the

Board Cir. No. 672 dtd. 16-12-1993 (205 ITR (St) 47) has clarified that allotment of

flats/houses by co-op. societies and other institutions, whose schemes of allotment

and construction are similar to those of DDA (as mentioned in para 2 of aforesaid

Cir. No. 471), would be treated as ‘construction’ for the purposes of Ss.

54 and 54F.

-

Board Cir. No. 667 dt.

18-10-1993 (204 ITR (St) 103) has clarified that for the purpose of computing

exemption u/s. 54 or 54F, the cost of the plot together with cost of the building

will be considered as cost of new asset, provided the acquisition of the plot and

also the construction thereon are completed within the period specified in these

sections.

-

Where new asset is

transferred within 3 years from date of its acquisition, or converted into money or

any loan/advance is taken on securities of specified bond, the amount of gains

earlier exempted shall be deemed to be LTCG in the year of such transfer or

conversion.

-

Cost of specified asset shall

not be considered for:

— rebate u/s. 88 up

to Assessment Year 2005-06;

— deduction u/s.

80C from Assessment Year 2006-07.

-

Where new asset is

transferred within 3 years from date of its acquisition or converted into money or

any loan/advances is taken on the security of specified assets, amount of gains

earlier exempted shall be deemed to be LTCG in year of such transfer or conversion.

-

Where new asset is

transferred within one year from date of its acquisition, amount of gains earlier

exempted shall be deemed to be LTCG in the year of such transfer.

-

The benefit of exemption

under section 54B extended to HUF with effect from 1st April, 2013.

-

Under section 54GB

18.1 “Eligible company”

means a company which fulfils the following conditions, namely:—

-

it is a

company incorporated in India during the period from the 1st day of April of the

previous year relevant to the assessment year in which the capital gain arises to the

due date of furnishing of return of income under sub-section (1) of section 139 by

the assessee;

-

it is engaged in

the business of manufacture of an article or a thing;

-

it is a company in

which the assessee has more than 50% share capital or more than 50% voting rights

after the subscription in shares by the assessee; and

-

iv. it is a company which

qualifies to be a small or medium enterprise under the Micro, Small and Medium

Enterprises Act, 2006;

18.2. “New asset” means new

plant and machinery but does not include—

-

any

machinery or plant which, before its installation by the assessee, was used either

within or outside India by any other person;

-

any machinery or

plant installed in any office premises or any residential accommodation, including

accommodation in the nature of a guest house;

-

any office appliances

including computers or computer software;

-

any vehicle; or

-

any machinery

or plant, the whole of the actual cost of which is allowed as a deduction (whether by

way of depreciation or otherwise) in computing the income chargeable under the head

“Profits and gains of business or profession” of any previous year.

18.3. As per the section, the amount of the net

consideration, which has been received by the company for issue of shares to the assessee, to the extent it is not utilised by the company for the purchase of the new

asset before the due date of furnishing of the return of income by the assessee under

section 139, shall be deposited by the company, before the said due date in an

account in any such bank or institution as may be specified and shall be utilised in

accordance with any scheme which the Central Government may, by notification in the

Official Gazette, frame in this behalf and the return furnished by the assessee shall

be accompanied by proof of such deposit having been made

18.4. If the equity shares of the company or the

new asset acquired by the company are sold or otherwise transferred within a period

of five years from the date of their acquisition, the amount of capital gain arising

from the transfer of the residential property which was not charged to tax, shall be

deemed to be the income of the assessee chargeable under the head “capital

gains” of the previous year in which such equity shares or such new asset are

sold or otherwise transferred, in addition to taxability of gains, arising on account

of transfer of shares or of the new asset, in the hands of the assessee or the

company, as the case may be.

18.5. The exemption is available in case of any

transfer of residential property made on or before 31st March, 2017.

18.6. Section 54GB shall be effective from 1st

April, 2013 and would accordingly apply from A.Y. 2013-14 and subsequent years.

NO TRANSFER FOR THE PURPOSES OF CAPITAL GAIN

Following transactions are not regarded as transfer for the purpose of Capital

Gain. (S. 47)

Distribution/Transfer of a Capital Asset

-

On total or

partial partition of H.U.F. [S. 47(i)]

-

Under a gift/an

irrevocable trust (except shares, debentures or warrants issued under ESOP/ESOS) or

under a will [S. 47(iii)]

-

By a company to its Indian

subsidiary company if Parent company held all the shares of Indian subsidiary

company [S. 47(iv)]

(see notes 1 and 2)

-

By a subsidiary company to the

Indian holding company if the Indian holding company held all the shares of

the subsidiary company.

[S. 47(v)] (see notes 1 and 2)

-

By the

amalgamating company to the Indian amalgamated company in a scheme of amalgamation. [S.

47(vi)]

-

Being shares held in an

Indian company by the amalgamating foreign company to the amalgamated foreign

company in the

scheme of amalgamation if [S. 47(via)]

-

at

least 25% of share holders of the first company remains share holders of the later

company,

and

-

there is no capital gains tax on such transfer in the country of first

company

-

A capital asset by a banking

company to a banking institution in a scheme of amalgamation sanctioned and brought

into force by the Central Government u/s. 45(7) of the Banking Regulation Act, 1949

[S. 47(viaa)]

-

By the demerged company to the

resulting company if the resulting company is an Indian company. [S. 47(vib)]

-

Being share or shares

held in an Indian company by the demerged foreign company to the resulting foreign

company, if

-

the share holders holding not less than 3/4th in the value of shares of the demerged

foreign company continue to remain share holders of the resulting foreign

company.

-

there is no capital gain tax on such transfer in the country in which the demerged

foreign company is incorporated. [S. 47(vic)]

-

Transfer by a

predecessor co-operative bank to a successor co-operative bank in a business reorganisation.

[S. 47(vica)]

-

Transfer of shares of a

predecessor co-operative bank against shares of successor co-operative bank in a

business reorganisation [S. 47(vicb)]

-

Transfer or issue of shares in

case of a demerger to share holders of demerged company by resulting company [S. 47(vid)] (In

the case of a demerger, there is a requirement under section 2(19AA)(iv) that the

resulting company has to issue its shares to the share holders of the demerged

company on a proportionate basis. It is proposed to amend the provisions of section

2(19AA) so as to exclude the requirement of issue of shares where resulting company

itself is a share holder of the demerged company. The requirement of issuing shares

would still have to be met by the resulting company in case of other share holders of

the demerged company. This amendment will take effect from 1st day of April, 2013 and

will accordingly apply to assessment year 2013-14 and subsequent assessment

years.)

-

Being shares held in the amalgamating

company by a share holder in a scheme of amalgamation against the allotment of shares in

the Indian amalgamated company “except

where the share holder itself is the amalgamated company ”[S. 47(vii)]

-

Being bonds or shares referred to in S.

115AC(1), made outside India by a non-resident to another non-resident. [S. 47(viia)]

-

Being items of national

importance specified in S. 47(ix) trf. to a University, National Museum, etc.

-

By conversion of bonds, debentures, etc.

into shares or debentures of same company [S. 47(x)]

-

Conversion of Foreign Currency

Exchangeable Bonds referred to in S. 115AC(1)(a) into shares or debentures of any

company. [S. 47(xa)]

-

Being membership of a recognised stock exchange,

on or before 31-12-1988, in exchange of shares by a person other than a

company to a company

“Membership of recognised stock exchange” is defined by explanation to S.

47(xi).

-

Being land of Sick Industrial company,

under a scheme of SICA 1985, where suchcompany is managed by its workers co-operative.

[S. 47(xii)]

-

Transfer of a capital asset

where an AOP or a BOI is succeeded by a company in the course of demutualisation or

corporatisation of a recognised stock exchange in India under a scheme approved by

SEBI provided all the assets and liabilities of the AOP/BOI are taken over by the

successor company. [S. 47(xiii)]

-

Sale/Transfer of any Capital

Asset. where a firm/Sole Proprietary Concern (SPC) is succeeded by a company, provided

following conditions are complied. [S. 47(xiii/xiv)]

IMPORTANT

CONDITIONS FOR FIRMS

-

All partners

become share holders in ratio of capital.

-

Aggregate shares

of old partners not to reduce below 50% of the total voting power for min. 5 years.

-

All assets and liabilities are taken over by new company

-

Partners not to

receive any benefit (other than shares) as a consideration

IMPORTANT

CONDITIONS FOR SOLE PROPRIETARY CONCERN (SPC)

-

Proprietor’s

shares not to reduce below 50% for minimum 5 yrs.

-

Conditions c &

d of firms also applicable to SPC.

-

Transfer of a membership right in a recognised stock exchange for acquisition of shares, and trading or clearing rights

under a scheme of demutualisation or corporatisation approved by SEBI. [S. 47(xiiia)]

-

Sale /transfer of capital asset where a private

company or unlisted public company is converted into a limited liability partnership

(LLP) provided following conditions are fulfilled: (see notes 2 and 3.) (S.

47(xiiib))

IMPORTANT

CONDITIONS FOR CONVERSION INTO LLPS

-

All the

assets and liabilities of the company before conversion are taken over by the new LLP

-

All the share

holders of the company become the partners of the LLP. The profit sharing ratio and

capital contribution are in the same proportion as their

share holding in the company

-

The share

holders do not receive any additional benefit

-

Aggregate profit

sharing ratio of the old

share holders not to reduce below 50% for min. 5 years.

-

The total

assets, turnover or gross receipts of the company in any three years preceding the

year of conversion do not exceed sixty lakhs

-

No amount is

paid to the partners out of the accumulated profits as on the date of conversion for

three years from the date of conversion.

-

Transfer in a scheme of lending of any securities

subject to the guidelines issued by SEBI, established under sec. 3 of SEBI Act, 1992

(15 of 1992) (or RBI constituted under sec. 3(1) of the RBI Act, 1934) [S. 47

(xv)].

-

Transfer of a capital asset in a

transaction of reverse mortgage under a scheme made and notified by the Central

Government [S. 47(xvi)] (retrospective from A.Y. 2008-09).

-

Section 46 (1) : Where assets of the company

are distributed to the share holders on liquidation of company, such distribution

shall not be regarded as transfer by company.

Notes

Note 1 : If there is any transfer of a

capital asset as a stock-in-trade after 29-2-1998 then clauses (iii) and (iv) given

above will not apply.

Note 2 : Please refer S. 47A for

withdrawal of exemption in certain cases.

Note 3 : The provisions of conversion

of company into LLP and necessary conditions to be fulfilled are proposed by the

Finance Bill, 2010. The same is yet to receive the Presidential assent .

|